If you want to save the most money, the best way to save money on car insurance rates is to do a yearly price comparison from companies who can sell car insurance in Oklahoma City. Rates can be compared by following these steps.

If you want to save the most money, the best way to save money on car insurance rates is to do a yearly price comparison from companies who can sell car insurance in Oklahoma City. Rates can be compared by following these steps.

- Spend some time learning about how your policy works and the modifications you can make to keep rates down. Many rating criteria that increase rates such as getting speeding tickets and an imperfect credit rating can be amended by improving your driving habits or financial responsibility. Read the full article for additional ideas to get lower rates and get bigger discounts.

- Obtain price quotes from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only quote rates from a single company like Progressive and State Farm, while agents who are independent can quote rates from many different companies.

- Compare the new rate quotes to the price on your current policy to see if switching to a new carrier will save money. If you find better rates and buy the policy, make sure coverage is continuous and does not lapse.

A good piece of advice is that you’ll want to compare identical deductibles and limits on every price quote and and to get price estimates from all possible companies. This enables a fair price comparison and many rates to choose from.

It’s an obvious assumption that car insurance companies don’t want customers comparing rates. People who compare other prices are likely to buy a new policy because they have good chances of finding a lower rate. A study discovered that consumers who compared rates once a year saved $70 a month compared to those who didn’t regularly shop around.

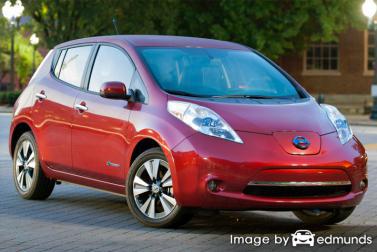

If finding the cheapest price for Nissan Leaf insurance in Oklahoma City is the reason you’re reading this, then having a good understanding how to compare auto insurance can save time and make the process easier.

If you are paying for car insurance now, you stand a good chance to be able to cut your premiums using these techniques. Buying the cheapest insurance in Oklahoma City can be easy if you know a few tricks. But Oklahoma vehicle owners do need to know the way companies sell online and use this information to your advantage.

Most of the larger companies such as Progressive, Allstate and GEICO provide prices online. Comparing prices online for Nissan Leaf insurance in Oklahoma City is possible for anyone as you simply type in your coverage preferences into a form. Once you submit the form, the system makes automated requests for your driving record and credit report and returns pricing information based on many factors. Quoting online for Nissan Leaf insurance in Oklahoma City simplifies rate comparisons, and it’s necessary to have as many quotes as possible in order to find the lowest possible payments on car insurance.

To save time and find out if lower rates are available, compare quotes from the companies shown below. If you currently have coverage, we recommend you input coverages and limits exactly as they are listed on your policy. This makes sure you will be getting rate comparison quotes for similar insurance coverage.

The following companies provide free rate quotes in Oklahoma. If several companies are displayed, it’s a good idea that you visit as many as you can to find the most competitive auto insurance rates.

Check for these discounts

Insuring your vehicles can cost a lot, but discounts can save money and there are some available that you may not know about. Some of these discounts will be visible when you complete an application, but a few must be asked for prior to getting the savings.

- 55 and Retired – Seniors could receive reduced rates.

- ABS Brakes – Cars, trucks, and SUVs equipped with ABS or steering control can reduce accidents so you can save 10 percent or more.

- Sign Early and Save – Some auto insurance companies give discounts for signing up prior to the expiration date on your current Leaf insurance policy. This can save 10% or more.

- Theft Prevention Discount – Vehicles with anti-theft systems are stolen with less frequency and earn discounts up to 10% off your Oklahoma City auto insurance quote.

- Oklahoma City Homeowners Discount – Just owning your own home can save a few bucks since home ownership requires a higher level of personal finance.

- Multi-line Discount – Larger auto insurance companies have a discount if you purchase a life insurance policy as well.

Discounts reduce rates, but you should keep in mind that most discount credits are not given to your bottom line cost. Some only reduce the cost of specific coverages such as liability and collision coverage. Despite the fact that it seems like you could get a free auto insurance policy, companies wouldn’t make money that way.

A partial list of companies that may include most of these discounts are:

If you need affordable Nissan Leaf insurance quotes, ask every insurance company the best way to save money. Some discounts might not apply in your state. To view providers with discount rates in Oklahoma, click here.

You Can Change Your Insurance Prices

Lots of things are considered when you get a price on insurance. A few of the factors are predictable such as your driving history, although others are more transparent such as your credit history or your vehicle rating. One of the most helpful ways to save on auto insurance is to to have a grasp of some of the elements that aid in calculating your auto insurance rates. When you understand what determines base rates, this enables you to make decisions that may reward you with big savings.

Extra coverages push up rates – Insurance companies have many add-on coverages that sound like a good idea at the time if you don’t pay attention. Coverages for vanishing deductibles, towing coverage, and Farm Bureau memberships are some examples. These may sound like a good investment when buying your policy, but if they’re wasting money think about removing them and cutting costs.

The more you drive the more you pay – The higher the mileage driven in a year’s time the more you’ll pay to insure your vehicle. The majority of insurers calculate prices partially by how you use the vehicle. Cars and trucks that sit idle most of the time receive lower rates than those used for commuting. Having the wrong rating on your Leaf may be wasting your money. Double check that your auto insurance coverage correctly shows the right rating data.

Bad drivers pay high costs – Being a careful driver impacts premiums far more than you think. Drivers with clean records get better rates than their less careful counterparts. Having a single ticket can increase rates twenty percent or more. Drivers who get flagrant violations such as DUI or reckless driving might be required by their state to maintain a SR-22 with their state in order to prevent a license revocation.

Certain occupations raise prices – Did you know that where you work can have an impact on rates? Jobs like fire fighters, airline pilots, and emergency personnel generally have higher rates than average attributed to intense work requirements and long work hours. Other jobs such as actors, engineers and performers pay lower than average rates.

Getting married can save on auto insurance – Being married actually saves money when shopping for auto insurance. Having a significant other generally demonstrates drivers are more financially stable and insurance companies reward insureds because married drivers tend to have fewer serious accidents.

City dwellers may pay more – Being located in less populated areas of the country can save you money if you are looking for the lowest rates. People who live in big cities have to deal with more road rage incidents and much longer commute distances. Less people living in that area corresponds to lower accident rates and lower theft and vandalism rates.

Higher deductibles are cheaper – Physical damage protection, also called comprehensive and collision insurance, helps pay for damage to your vehicle. Some coverage claims could be a windshield shattered by a rock, hail damage, and windstorm damage. Your deductibles are how much you are willing to pay before a claim is paid by your company. The higher the amount you pay before a claim is paid (deductible), the lower your rates will be.

Nissan Leaf insurance loss data – Companies take into consideration insurance loss statistics for every vehicle as a way to help calculate a profitable premium rate. Models that tend to have higher prevalence or dollar amount of losses will have higher rates for specific coverages.

The next table shows the loss history for Nissan Leaf vehicles. For each coverage category, the loss probability for all vehicles, without regard to make or model, is equal to 100. Percentage values below 100 suggest a positive loss record, while numbers above 100 indicate frequent claims or an increased likelihood of larger losses.

| Vehicle Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Data Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

What if I want to buy from local Oklahoma City insurance agents?

A small number of people still prefer to get advice from a local agent and often times that is recommended A good thing about price shopping on the web is the fact that you can find lower rates and still choose a local agent.

By using this form (opens in new window), your coverage information is submitted to insurance agents in Oklahoma City that can give you free Oklahoma City auto insurance quotes to get your business. There is no need to contact any agents because prices are sent directly to you. It’s the lowest rates and work with a local agent. In the event you want to get a price quote from one company in particular, you can always navigate to their website and complete a quote there.

Choosing an company is decision based upon more than just a cheap quote. Any agent in Oklahoma City should have no problem answering these questions:

- Is coverage determined by price?

- Does the agency provide any after hours assistance?

- How much can you save by raising your physical damage deductibles?

- Is vehicle mileage a factor when determining depreciation for repairs?

- Are glass claims handled on-site or do you have to take your vehicle to a repair shop?

- Will you work with the agent or an assistant?

- When do they do a full risk review?

- Does the quote include credit and driving reports?

Upon receiving acceptable answers to your questions and inexpensive Nissan Leaf insurance in Oklahoma City quotes, you’ve probably found an insurance company that can be relied on to properly service your insurance policy. Just keep in mind you can terminate your policy at any point so never assume you are locked into any specific company with no way to switch.

Smart consumers save more

Affordable Nissan Leaf insurance in Oklahoma City can be found on the web and from local insurance agents, and you need to comparison shop both to get a complete price analysis. Some insurance providers do not offer rates over the internet and most of the time these smaller providers sell through independent agencies.

When shopping online for auto insurance, do not reduce needed coverages to save money. There are a lot of situations where an accident victim reduced physical damage coverage only to regret at claim time that they should have had better coverage. Your focus should be to find the BEST coverage for the lowest price, not the least amount of coverage.

Additional information can be read at the links below

- How Does Hitting a Deer Impact Insurance Rates? (Allstate)

- Who Has Affordable Oklahoma City Auto Insurance for 16 Year Olds? (FAQ)

- Pickups fall short in headlight tests (Insurance Institute for Highway Safety)

- Electronic Stability Control FAQ (iihs.org)